Paul Coulson’s glass and packaging group, Ardagh, is likely to proceed with its long-awaited stock market launch in the second half of next year.

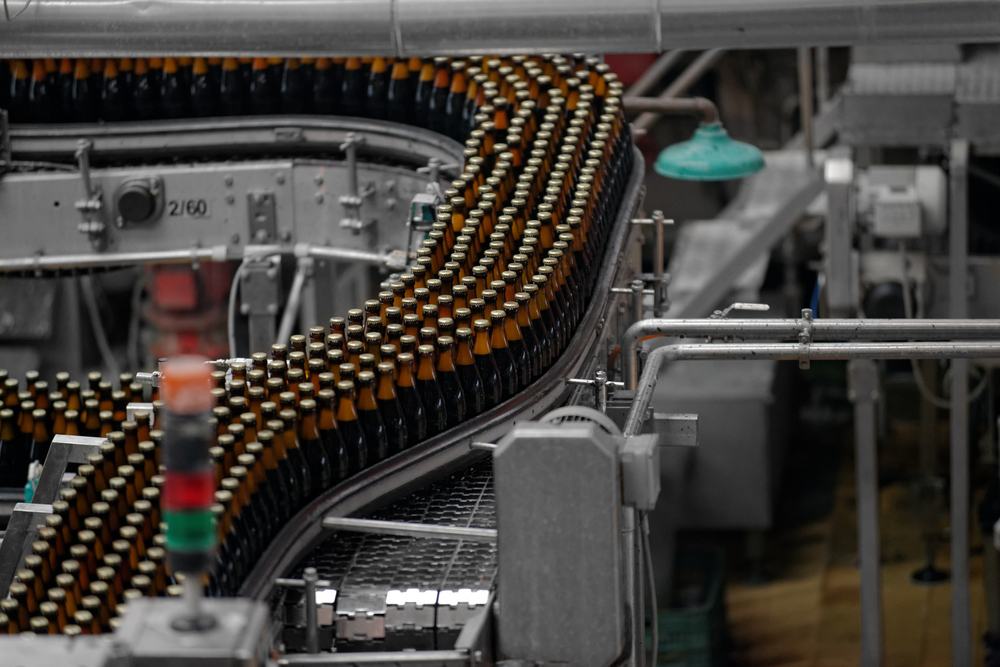

The Irish-backed multinational, which supplies bottles to the likes of Coca Cola, Budweiser and Heineken, shelved plans to float on Wall Street in 2011, citing market volatility.

However, it said yesterday that, following a review of its funding options, it would be in the group’s best interests to proceed with plans for an initial public offering (IPO) of its shares in the second half of 2015.

The group is not likely to determine how much it will raise from its planned IPO until nearer the flotation date, but proceeds are likely to go towards paying down its €3 billion-plus debt and on acquisitions.

Given that it is one of the biggest players in its sector in the US and went through most of the formal application process with that country’s stock market regulator, the Securities and Exchange Commission, in 2011, it is thought that it will opt to sell its shares in New York.

Luxembourg-based Ardagh has its roots in the Irish Glass Bottle manufacturing business founded in Dublin in 1932 and has a large number of Irish shareholders, including Mr Coulson, who owns more than 30 per cent of the group and is its chairman.

It makes bottles, jars and tins used in packing everything from beer to salmon, and has businesses across Europe and the US, where last month it completed the purchase of Verallia North America for some €1.3 billion, making it one of the market’s biggest players. Sale of Anchor Glass As a condition of that purchase, it agreed with US mergers watchdog the Federal Trade Commission to sell a smaller business, Anchor Glass, which Waterford Crystal owner KPS Capital Partners picked up for just under $500 million .

Yesterday, Ardagh reported that sales in the first three months of this year rose 1 per cent on the same period in 2013 to €968 million. Earnings before interest, tax, depreciation and amortisation rose €13 million to €155 million.

Refinancing some debt cut interest payments by €15 million during the quarter. This does not include payments related to the Verallia deal, which was bought using borrowings of more than $1.5 billion.

Revenue from its European glass business was up 2 per cent at €327 million, while in the US it grew by almost 2 per cent to €161 million. Turnover in its metal division was flat at €480 million.

Scenarios:

-

"A breath of fresh air. Your firm demonstrated enormous commercial understanding in turning around negotiations with a potential target vendor. I admire your style and ability to drive the deal forward. Many thanks."

"A breath of fresh air. Your firm demonstrated enormous commercial understanding in turning around negotiations with a potential target vendor. I admire your style and ability to drive the deal forward. Many thanks." -

"I would like to say I'm very happy with your service, especially the audit team, your staff are always friendly, helpful and a pleasure to deal with."

"I would like to say I'm very happy with your service, especially the audit team, your staff are always friendly, helpful and a pleasure to deal with." -

"Your business approach to clients is very impressive. I have always found that when explaining the types of service on offer, it is always concise and straight forward. The level of trust that clients place in your company and its staff speaks volumes."

"Your business approach to clients is very impressive. I have always found that when explaining the types of service on offer, it is always concise and straight forward. The level of trust that clients place in your company and its staff speaks volumes." -

"I would like to take this opportunity to say how much we are impressed with your company's professionalism, it has been a pleasure working with you all and we look forward to working with you in the future."

"I would like to take this opportunity to say how much we are impressed with your company's professionalism, it has been a pleasure working with you all and we look forward to working with you in the future." -

"Avid Partners - Accountants & Business Advisors are an excellent firm of accountants, their quality ethos is outstanding."

"Avid Partners - Accountants & Business Advisors are an excellent firm of accountants, their quality ethos is outstanding." -

"I have dealt with Jamie O' Hanlon, of Avid Partners - Accountants & Business Advisors Chartered Certified Accountants, for a number of years as he is auditor to one of my clients. I have always found him to be professional and responsive in his approach."

"I have dealt with Jamie O' Hanlon, of Avid Partners - Accountants & Business Advisors Chartered Certified Accountants, for a number of years as he is auditor to one of my clients. I have always found him to be professional and responsive in his approach." -

"Service is second to none; there is always someone at the end of the phone for any business advice. The staff are very easy to get along with, very approachable and know exactly what they are talking about"

"Service is second to none; there is always someone at the end of the phone for any business advice. The staff are very easy to get along with, very approachable and know exactly what they are talking about" -

Having got to know the company through the BNI we decided it was time to change accountant. What impressed me about Avid Partners was their professionalism. Their attention to detail was second to none and as an added bonus they are a sounding board to all of my questions. Avid also potted some irregularities in my accounts from the previous few years and saved me substantial money on the years tax bill. Avid Partners deliver a first class service which is everything you could want from an accountant and I am happy to give this endorsement.

Having got to know the company through the BNI we decided it was time to change accountant. What impressed me about Avid Partners was their professionalism. Their attention to detail was second to none and as an added bonus they are a sounding board to all of my questions. Avid also potted some irregularities in my accounts from the previous few years and saved me substantial money on the years tax bill. Avid Partners deliver a first class service which is everything you could want from an accountant and I am happy to give this endorsement. -

We at Fitzies Bar have worked with Avid Partners - Business & Financial Advisers for over five years. We find that the advice and support offered to us in addition to all of our book-keeping requirements to include payroll, VAT, etc. is invaluable and has helped to contribute to our continued growth especially in these challenging times. I would have no hesitation in recommending Avid Partners.

We at Fitzies Bar have worked with Avid Partners - Business & Financial Advisers for over five years. We find that the advice and support offered to us in addition to all of our book-keeping requirements to include payroll, VAT, etc. is invaluable and has helped to contribute to our continued growth especially in these challenging times. I would have no hesitation in recommending Avid Partners. -

Jamie and his staff are a pleasure to work with. They respond promptly to any queries we have and are critical to our financial planning and the future needs of our business. I would highly recommend them to anyone interested in accounting services.

Jamie and his staff are a pleasure to work with. They respond promptly to any queries we have and are critical to our financial planning and the future needs of our business. I would highly recommend them to anyone interested in accounting services. -

We at Stillorgan Cycles have used Jamie and his Team at Avid Partners – Accountants and Business Advisers for over five years. We have found that the retail advice and support offered to us is second to none and has helped to contribute to our continued growth especially in these challenging times. I would have no hesitation in recommending Avid Partners.

We at Stillorgan Cycles have used Jamie and his Team at Avid Partners – Accountants and Business Advisers for over five years. We have found that the retail advice and support offered to us is second to none and has helped to contribute to our continued growth especially in these challenging times. I would have no hesitation in recommending Avid Partners. -

I met Avid Partners through a local business networking group. We had been using the same accountants for years and found that in these harsh economic times that we were not getting good enough value or service. We were very impressed by the company's professionalism and enthusiasm and genuine interest in helping us get the most out of our business. As a result we are now clients of Avid Partners and are thrilled with our decision.

I met Avid Partners through a local business networking group. We had been using the same accountants for years and found that in these harsh economic times that we were not getting good enough value or service. We were very impressed by the company's professionalism and enthusiasm and genuine interest in helping us get the most out of our business. As a result we are now clients of Avid Partners and are thrilled with our decision.